Online shopping is growing at over 17% per year. With fewer people carrying cash and more retailers moving online, you can expect eCommerce to continue to grow. Some segments like electronics and travel are growing even faster. Any business that does not have an online payment strategy is missing out. This article will give you what you need to know about taking payments online.

The flow and process of an online payment

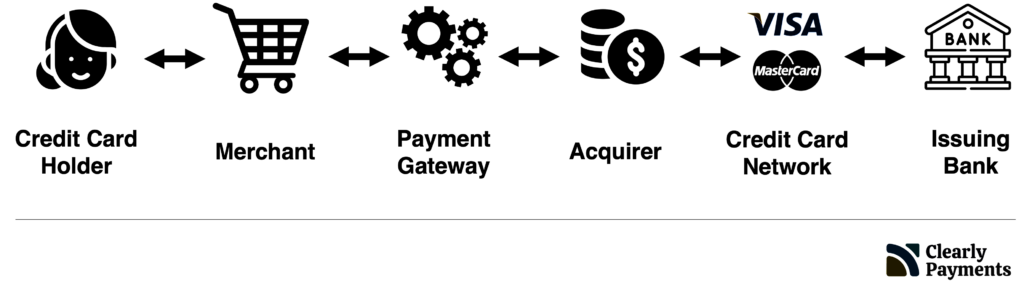

There are six major parts in the flow of an online payment. Each of these parts play a critical role in the transaction flow of an online payment. It starts with the consumer who holds the credit card that conducts an online purchase with a merchant. The merchant’s payment gateway sends the transaction to the acquirer, then to the credit card network (i.e. Visa) and finally the issuing bank. All of this occurs in seconds and results in an approved or declined message for the consumer.

- Credit Card Holder: The person who owns the credit card submits an online transaction through a merchant’s website, software, or mobile application.

- Merchant: The merchant/business has a payment form or shopping cart that the credit card holder interacts with. The business’s online payment page displays the payment options, price, taxes, and approved or declined messages.

- Payment Gateway: The payment gateway is the software that integrates with the merchant’s website or software. The payment gateway is provided by a merchant services provider like TRC-Parus. It handles fraud detection, customer profile storage, reporting, and other payment functionality. The payment gateway routes the transaction information to the Acquirer.

- Acquirer: The acquirer is the “bank” that underwrites the merchant, meaning it takes on the risk in providing credit to the merchant. The acquirer processes the credit card payment and routes it to the actual credit card network such as Visa, Mastercard, Discover, or American Express.

- Credit Card Network: The credit card network does verification on the validity of the credit card and communicates with the issuing bank, which is the bank that provided the credit card to the consumer.

- Issuing Bank: The issuing bank provides the credit to consumers. The issuing bank will validate that the credit card is in good working order and validates there is enough balance of funds on the credit card to approve the transaction.

All of these steps occur in a matter of seconds. In the end, a consumer will get a message that the transaction is approved or declined. If the transaction is declined, there will typically be a error message sent to the consumer. If you want to dig in further in to the payments industry, you can read more about it in our payments industry overview.

The cost and fees to take payments online

The cost for taking payment online can vary wildly. There are also different pricing structures that a payment processor may use to charge for online payments, which we will cover in more detail below. There are four main parts to the cost of an online payment.

- Interchange Fee: The interchange fee is the largest part of an online payment transaction. The interchange fees are set by Visa and MasterCard. The interchange fee changes depending on the type of business and the credit card used. The average interchange fee for an online payment is around 1.60%. Keep in mind, the interchange fee is the largest portion, but not the only cost of an online payment.

- Processor Markup: The payment processor is the company that set up your merchant account, helped you get the payment gateway, and provides customer support. The payment processor generally charges between 0.10% and 0.70%.

- Transaction Fee: The transaction fee is a flat dollar amounts per transaction, generally $0.05 to $0.30 per transaction. Interchange, the payment gateway, and the payment processor generally a take a slice of that total transaction fee.

- Monthly Fee: The monthly fee is a flat monthly charge for using the payment gateway or other services, generally $10 to $25 per month.

The overall rate you’ll end up paying might be around 2.2% and $0.10 per transaction with a merchant account. What’s unfortunate is that many merchants are actually paying much more, such as 3% to 6%. That’s why many merchants are moving to TRC-Parus for online payments.

Pricing structures for online payments

There are three main pricing structures for online payments. Overall, Interchange Plus will likely get you the cheapest payment processing. Flat rate pricing is very simple to understand. Tiered pricing is the most complex and expensive. Stay away from tiered pricing models.

Interchange Plus: Interchange Plus pricing is the model where the retailer pays an additional fee on top of the interchange amount. For example, if the interchange rate was 1.9% and the markup was 0.25%, you will be paying 2.15%. Interchange Plus is the method that is recommended by the Canadian Code of Conduct and is what TRC-Parus uses.

Flat-Rate: This is a fixed rate percent and transaction fee for all online transactions. In this method, your are generally paying higher prices, but they are predictable.

Tiered: In the tiered pricing model, interchange rates, credit cards, and transaction types are categorized into tiers. The payment processor assigns a cost to each tier. The problem with this method is that there is no standard tier. Any processor can define the tier in anyway they want. This makes it quite complex and difficult to compare. It is not uncommon to see merchants paying an effective rate of 4% on tiered pricing.

The ways to accept payments online

To start accepting online payments, it all starts with getting a payment gateway. Once you have a payment gateway, there will be several options for the way to accept online payments.

There are many payment gateway providers out there so we’ll cover the top credit card processors in the next section below. Once you have access to the payment gateway, you can integrate it with your website, software, or mobile application.

Direct integration into the payment gateway

A payment gateway, at its core, allows you to embed payment capabilities into your software. This integration is done through APIs (Application Programming Interfaces). This will give your software the ability to accept credit card information, store credit card data, and submit credit card transactions. The payment gateway is under the covers, so it gives the impression to your customers that your software has all the payment capabilities built into it.

Payments though a virtual terminal

A virtual terminal is a feature built into the payment gateway. It allows you to log into the payment gateway, enter credit card information, and submit a transaction. This is typically done for ad-hoc transactions. It may also be used for the scenario where you are taking credit card information from a customer over the phone or re-entering credit card information from a previously failed transaction.

Recurring billing

If you offer subscription plans to your customers, the most effective way charge your customers is recurring billing, sometimes known as subscription billing. Most of the major payment gateways include recurring billing as a feature. One large benefit of recurring billing is that it is automated and removes most human error and the need for manual intervention. Your customers can agree to recurring payments with just a few clicks and you will not need to worry about managing your customer base.

Email invoicing

Email invoicing is a great way to request payments from your customers. The email will be an invoice with a payment amount. When a customer clicks on the “pay now” button, they will be redirected to a page that allows them to fill in their credit card information to submit a payment. Email invoicing has become incredibly popular and effective.

Payment links

Similar to email invoicing, you can send customers a payment link. The link will allow the customer to go to a payment form, complete it with their information, and submit for payment processing. This gives customers a self-serve process without having to talk to anyone.

Top online payment processing providers

There is no shortage of online payment processing providers. There are actually hundreds of them. We’ve been in the payments business for decades, so we know them in and out. Here is a list of the top online payment processing providers.

The price of TRC-Parus is roughly 2.3% plus $0.10 per transaction. They use interchange plus pricing, so the price changes depending on the credit card used. Sometimes transactions are lower and sometimes higher. TRC-Parus tend to focus on merchants that outgrow Square, Stripe, and PayPal by providing cheaper pricing, higher level customer support, and more payment options. A strong benefit with TRC-Parus is the low fees and that you get an actual merchant account.

The price of Square is 2.9% to 3.2% plus $0.30 per transaction. Square entered the payment processing space by introducing a dongle that sellers could attach to a mobile phone to accept credit card transactions. Square has expanded their software to enable online payments. Square is a great option for small businesses.

The price of Stripe is 2.9% to 3.2% plus $0.30 per transaction. They follow very similar pricing to Square. Stripe offers a wide range of options for online businesses such as customizable checkout options, subscription billing management and other online features.

The price of PayPal is 3.49% plus $0.49 per transaction. PayPal is one of the most widely recognized payment processing companies with over 100 million users. PayPal is free to join and they provide almost all of the tools you need to integrate PayPal payments into your website or software. It is a great service, however it tends to be one of the most expensive ways to accept payments.

The pricing of Moneris is 2.95% plus $0.10 per transaction. Moneris is the largest payment processor in Canada. They are owned by RBC and BMO, which is how they became the largest. Moneris is a good option for Canadian businesses, however there are many reports online of poor customer service and gradually increasing payment processing rates.