The payments industry has been revolutionized in recent years by technological advancements, changing consumer behavior, and the growing demand for digital payments. This industry encompasses a range of services and technologies, including credit card processing, mobile payments, online payments, point-of-sale systems, digital wallets, and other electronic payment methods. In this article, we cover the size, sectors, and growth drivers of the payments industry.

The size and growth of the payments industry

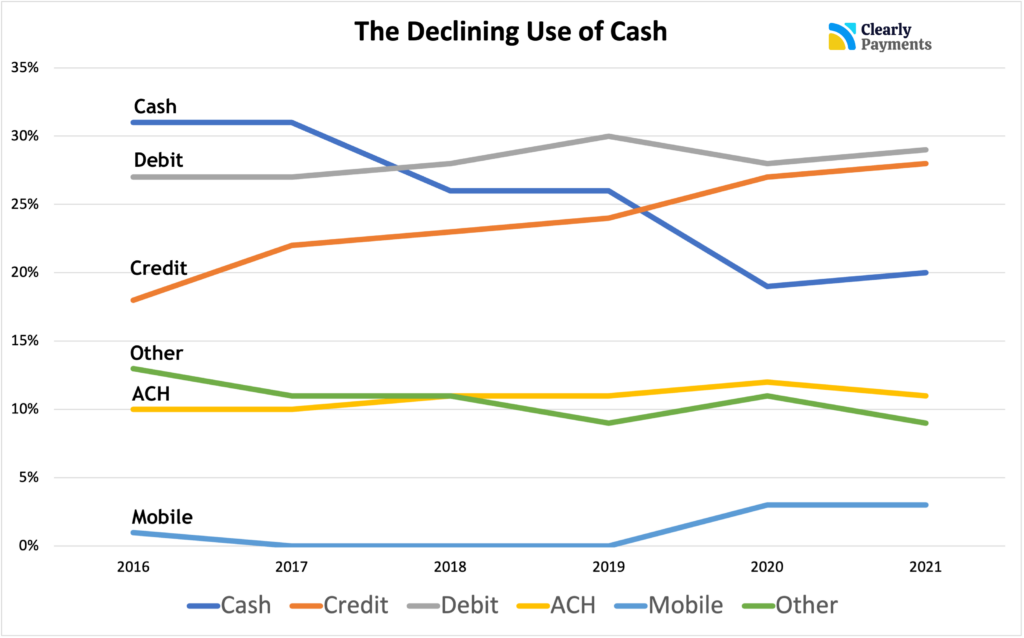

The payments industry includes a wide range of companies and payment methods, including credit cards, debit cards, mobile payments, digital wallets, and more. With the continued growth of eCommerce and the increasing adoption of digital payments around the world, the payments industry is expected to continue expanding in the years ahead. Technically cash and checks are a historically important part of payments, however cash and checks are on a drastic decline in favour of digital payments. This is why we focus on digital payments.

Total transaction value in digital payments, according to Statistica, is projected to reach USD $9.46 trillion in 2023. Total transaction value is expected to show an annual growth rate of 11.80% resulting in a projected total amount of USD $14.78 trillion by 2027. The market’s largest segment is digital commerce with a projected total transaction value of USD $6.03 trillion in 2023.

The growth of the payments industry is fueled by several factors, including the increasing adoption of mobile payments, the growth of eCommerce, and the increasing demand for contactless payment methods. The COVID-19 pandemic has also accelerated the shift toward digital payments as consumers seek out contactless payment options.

Sectors in the payments industry

The payments industry encompasses a wide range of businesses and services, from traditional credit and debit cards to emerging technologies like blockchain and cryptocurrency. One of the most significant segments of the payments industry is card payments, which enable consumers to make purchases using credit or debit cards. These transactions are processed through payment networks like Visa and Mastercard, which enable funds to be transferred from the consumer’s bank account to the merchant’s account.

Another rapidly growing segment of the payments industry is mobile payments and digital wallets. Services like Apple Pay and Google Pay allow consumers to store their payment information on their smartphones, making it easier and more convenient to make purchases both in-store and online. Digital wallets also offer additional security features, such as biometric authentication and tokenization, that help protect users’ financial information.

Electronic funds transfer is another segment of the payments industry that has been transformed by technology. Services like ACH and EFT payments and direct deposits enable consumers to transfer funds electronically between bank accounts, making it faster and easier to pay bills and make other financial transactions.

Credit card processing and merchant acquiring is another critical segment of the payments industry. This segment includes payment processors and point-of-sale (POS) hardware and software providers that enable merchants to accept and process payments. With the growth of eCommerce, merchant acquiring has become increasingly important, as more businesses look for ways to accept online payments securely and efficiently.

Cross-border payments and international remittance are other areas of the payments industry that have seen significant growth in recent years. As more businesses operate globally, the ability to transfer funds across borders quickly and securely has become increasingly important. Companies that specialize in cross-border payments, such as currency exchange providers and international wire transfer services, have emerged to meet this demand.

Finally, alternative payment methods are a newer segment of the payments industry that has been gaining traction in recent years. These payment methods, which include cryptocurrency and blockchain-based payments, offer users greater privacy and security than traditional payment methods. While still relatively small compared to other segments of the payments industry, alternative payment methods are expected to continue growing as more consumers and businesses embrace these emerging technologies.

Drivers of growth of the payments industry

The growth of the payments industry has been driven by several factors, including the increasing use of eCommerce and online shopping, the rise of mobile devices, and the growing demand for fast and convenient payment options. In the past, payments were primarily made using cash or checks, but today, electronic payments have become the norm.

One of the most significant developments in the payments industry has been the rise of mobile payments. With the proliferation of smartphones and mobile devices, consumers have become increasingly comfortable using their devices to make payments. Mobile payments allow consumers to pay for goods and services using their mobile devices, without the need for cash or cards.

Another important trend in the payments industry is the growth of online payments. Online payments enable consumers to make purchases on the internet using their credit or debit cards, without the need for a physical card reader. This has led to the growth of eCommerce with consumers shopping online for everything from groceries to clothing to electronics.

The payments industry has also been impacted by regulatory changes. In recent years, governments around the world have been tightening regulations on the payments industry to protect consumers and reduce the risk of fraud. This has led to the development of new technologies and standards to ensure that payments are secure and compliant with regulations.

One of the biggest challenges facing the payments industry is the issue of security. As the number of electronic transactions grows, so does the risk of fraud and cybercrime. To combat this, the industry has developed new security technologies, such as tokenization and biometric authentication, to protect consumers’ sensitive information.

The payments industry is also increasingly focused on providing a seamless user experience. With so many payment options available, consumers are looking for solutions that are fast, easy, and convenient. To meet this demand, the industry is investing heavily in new technologies, such as contactless payments and digital wallets, to make payments faster and more convenient.