There is a lot that happens in a credit card transaction. There is consumer identity verification, merchant status verification, fraud detection, and bank communication. All this happens in seconds. Credit card networks like Visa can handle 24,000 transactions per second. That’s a highly scalable system.

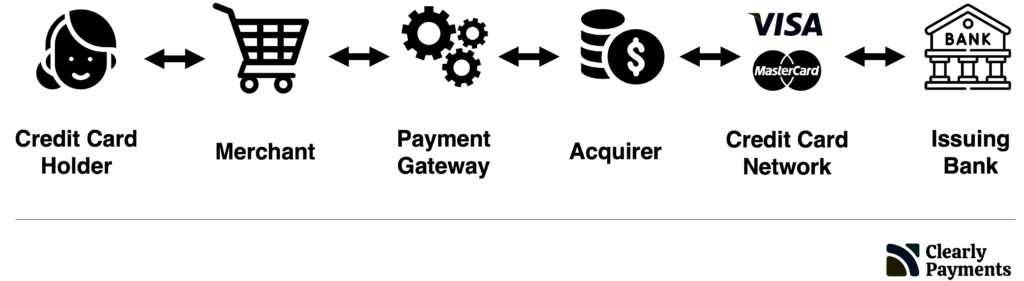

The complexity of a credit card transaction can be easily overlooked. There are many different companies involved that each focus on their own part of the transaction. In a credit card transaction, there are six major steps. Each of these steps play a critical role in the transaction flow in payment processing.

A transaction starts with the consumer who holds the credit card that conducts a purchase from a merchant. The merchant’s payment gateway or credit card machine sends the transaction to the acquirer, then to the credit card network (i.e. Visa) and finally the issuing bank. All of this occurs in seconds and results in an approved or declined message for the consumer.

The below image shows a “Payment Gateway”. Technically, a payment gateway is only used in an online payment for eCommerce. However, if it is a in-store purchase with a credit card machine, you can replace Payment Gateway with Credit Card Machine.

- Credit Card Holder: The person who owns the credit card submits an online transaction through a merchant’s website, software, or mobile application.

- Merchant: The merchant/business has a payment form or shopping cart that the credit card holder interacts with. The business’s online payment page displays the payment options, price, taxes, and approved or declined messages.

- Payment Gateway or Credit Card Machine: The payment gateway or credit card machine is the software or hardware that facilitates the payment from the merchants store or website. The payment gateway or credit card machine is provided by a merchant services provider like TRC-Parus. This steps validates the consumer’s credit card and routes the transaction information to the Acquirer.

- Acquirer: The acquirer is the “bank” that underwrites the merchant, meaning it takes on the risk in providing credit to the merchant. The acquirer processes the credit card payment and routes it to the actual credit card network such as Visa, Mastercard, Discover, or American Express.

- Credit Card Network: The credit card network does verification on the validity of the credit card and communicates with the issuing bank, which is the bank that provided the credit card to the consumer.

- Issuing Bank: The issuing bank provides the credit to consumers. The issuing bank will validate that the credit card is in good working order and validates there is enough balance of funds on the credit card to approve the transaction.

There is even more happening behind the scenes that what is described here, however this gives a general overview of how a credit card transaction works in payment processing.