The world of credit card processing and merchant accounts can be confusing, with various types of organizations involved and complex fee structures.

Merchant accounts are necessary for businesses that want to accept credit card payments. Some merchants find credit card acceptance convenient and cost-effective, while others struggle with the fees that eat into their margins. Regardless, merchants can benefit from becoming more informed about the process.

When it comes to getting a new merchant account or switching providers, there are numerous companies vying for your business. You can find merchant service providers through online searches, your bank, or even through salespeople contacting you. The important thing is to choose the best provider that suits your business needs.

By understanding the basics of merchant accounts and selecting the right provider, businesses can improve their credit card acceptance and navigate the complexities of the industry more effectively.

In the realm of merchant service providers, there are two main types: acquirers and resellers, also known as Independent Sales Organizations (ISOs) or Merchant Service Providers (MSPs). While the initial inclination may be to choose an acquirer to bypass intermediaries, the decision is not as straightforward as it may seem. Let’s explore the nuances of these options to understand why it’s not a clear-cut choice.

What is an ISO in payments?

ISOs (Independent Sales Organizations) play a pivotal role in the payments industry as intermediaries between acquirers and merchants. These organizations form partnerships with acquirers to offer a wide range of payment services and products to businesses seeking payment processing solutions. ISOs come in various sizes and structures, encompassing small owner-operated businesses to large multinational corporations. Their diverse presence caters to the unique needs of merchants across different sectors and geographic locations.

One of the primary functions of ISOs is merchant acquisition. They actively seek out and acquire new merchant accounts by showcasing the benefits of partnering with their affiliated acquirers. ISOs possess a deep understanding of payment processing solutions and can effectively communicate the features, fees, and advantages to potential merchants. By presenting tailored payment options, ISOs empower businesses to make informed decisions that align with their specific requirements.

To drive business growth, ISOs employ strategic sales and marketing tactics. They develop comprehensive strategies to promote payment processing services to potential merchants. This entails a range of activities, including advertising campaigns, lead generation, and the establishment of strategic partnerships with other businesses or organizations. Through these initiatives, ISOs expand their market reach and foster valuable connections that contribute to their overall success.

ISOs also play a vital role in facilitating the application process for merchant accounts. They assist merchants in completing applications, gather the necessary information, and ensure the submission of required documents. By guiding businesses through this process, ISOs alleviate potential complexities and streamline the onboarding experience, enabling merchants to access payment processing services efficiently.

In some cases, ISOs undertake preliminary underwriting or risk assessment of merchant applications. By evaluating factors such as the nature of the business, financial stability, and potential risks, ISOs help determine the likelihood of approval for merchant accounts. While ISOs may conduct this initial underwriting, it is important to note that final underwriting decisions are typically made by the acquirers.

Beyond the initial setup, ISOs provide ongoing training and support to merchants. They offer comprehensive guidance on the utilization of payment processing equipment, software, and systems. Additionally, ISOs serve as a valuable resource for troubleshooting and resolving any issues that may arise during payment transactions. This continuous support ensures that merchants can operate smoothly and efficiently while maximizing the benefits of their chosen payment processing solutions.

Moreover, certain ISOs distinguish themselves by developing their own payment software and hardware. These innovative ISOs leverage their expertise to create proprietary solutions tailored to meet the unique needs of their merchants. This may include developing mobile payment applications, payment gateways, or other specialized software and hardware solutions. By offering these cutting-edge technologies, ISOs enable merchants to embrace advanced payment processing capabilities and stay ahead in an increasingly digital world.

ISOs operate within the regulatory framework established by card networks such as Visa, Mastercard, and American Express. Compliance with industry rules and regulations is vital to ensure the integrity and security of payment transactions. ISOs adhere to these guidelines, working closely with acquirers and other industry stakeholders to maintain a trustworthy and transparent ecosystem for merchants and consumers alike.

Payment acquirers vs ISOs

Acquirers play a crucial role in the payments industry as they possess the technical capability to process transactions. In order to be classified as an acquirer, a company must have the infrastructure to receive transaction data from merchants through the internet. They then communicate with the relevant financial institutions to authorize or decline transactions. Additionally, acquirers are responsible for settling completed transactions, ensuring that funds are deposited into the merchant’s bank account.

The processing industry exhibits a high level of concentration with the top five acquirers accounting for over 70% of the total transaction volume. These acquirers can be either banks or non-banks, reflecting the diverse range of players in the market.

While some acquirers do maintain their own direct sales force, they primarily collaborate with ISOs to acquire and retain their merchant base. This business model allows acquirers to capitalize on economies of scale, functioning as high-volume operations that rely on ISOs to handle the sales function. It is reasonable to estimate that 80% of merchants in North America that have merchant accounts work with an ISO for their payment processing needs.

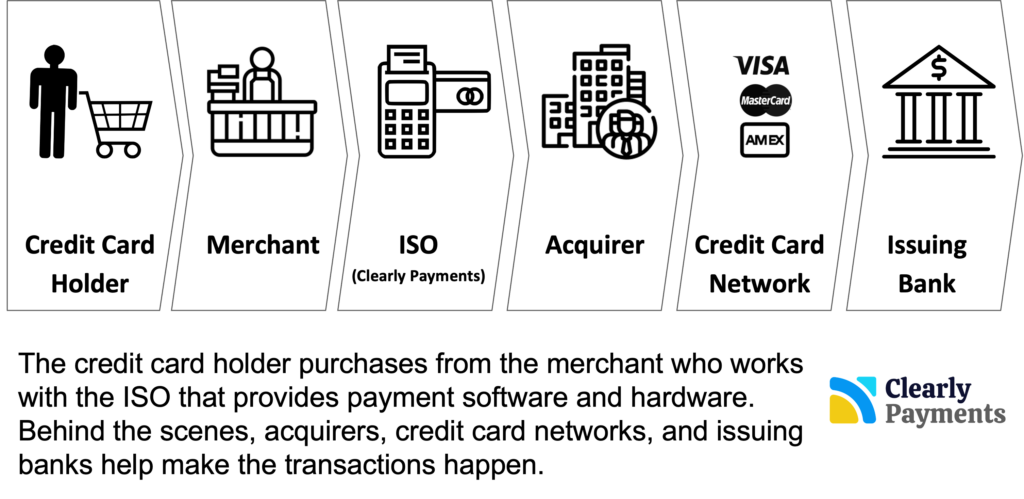

How ISOs Fit into the Payments Value Chain

You can read the full article about the credit card processing and payments industry. It covers the key players, the value chain, and more on industry dynamics.

Two types of ISOs

ISOs can be classified into two main types: Bank ISOs and Non-Bank ISOs.

Bank ISOs: Many banks, both large and small, operate as ISOs. For instance, Wells Fargo serves as an ISO of First Data. Local community banks and regional banks often function as ISOs as well. Banks are drawn to the merchant services business due to its alignment with their existing product and service offerings.

It allows them to enhance their average revenue per customer. In most cases, banks private label their services, making it challenging to differentiate whether they are a processor or an ISO. Working with a bank can offer the advantage of consolidating your financial services. However, it may come with the limitation of receiving standardized, off-the-shelf solutions and services.

Non-bank ISOs: Non-bank ISOs encompass a wide spectrum of providers, ranging from highly capable and innovative companies to those that do not represent the industry well. These non-bank ISOs often bring fresh perspectives and innovative solutions to the table. They can offer more tailored and flexible options compared to traditional banking institutions. However, it’s essential to carefully evaluate non-bank ISOs, as their capabilities, reputation, and level of service can vary significantly.

Understanding the distinctions between these two types of ISOs allows you to assess the advantages and limitations associated with each. It’s crucial to conduct thorough research, consider your specific needs, and carefully evaluate potential ISO partners before making a decision. Choosing the right ISO can have a significant impact on your payment processing experience and overall business operations. TRC-Parus prides itself on being a best-of-breed ISO.

Payment industry dynamics

The payments industry presents an intriguing landscape characterized by specific dynamics that demand careful consideration from merchants. Two prominent factors contribute to the unique nature of this industry: minimal barriers to entry and the absence of a comprehensive regulatory body overseeing and enforcing industry practices. These conditions necessitate a cautious and meticulous approach when selecting a payment service provider.

One key aspect of the payments industry is the relatively low barriers to entry. Unlike many other industries that require certifications, licenses, or significant capital investments, the payments sector allows relatively easy access for new players. While this fosters competition and innovation, it also means that the market is populated by a diverse range of providers, varying in terms of experience, capabilities, and reliability. As a result, merchants must exercise due diligence to ensure they choose a provider that meets their specific needs and aligns with their business goals.

Furthermore, the absence of a centralized regulatory body adds another layer of complexity to the payments industry. Unlike sectors governed by stringent regulatory frameworks, such as banking or healthcare, the payments landscape operates with a more decentralized approach to regulation. While industry associations and networks, such as card networks, establish guidelines and best practices, there is no single regulatory authority overseeing and enforcing compliance. This lack of centralized regulation can create challenges for merchants seeking reassurance and accountability from their chosen payment service provider.

Given these industry dynamics, merchants must be diligent in their selection process to mitigate potential risks. Thorough research, due diligence, and careful evaluation of providers become imperative to ensure the reliability, security, and compliance of the chosen payment service provider.

It is essential to consider factors such as the provider’s track record, reputation, security measures, customer support, and adherence to industry standards. Engaging in discussions with potential providers, asking relevant questions, and seeking references or testimonials can provide valuable insights into the provider’s capabilities and commitment to meeting merchant needs.