In the HVAC industry, staying ahead of the curve is crucial for success. One such advancement that has revolutionized the way HVAC companies operate is the adoption of credit card payments.

Beyond the conventional methods of accepting cash or checks (which are declining), integrating credit card payments into your business model can enhance efficiency, customer satisfaction, and overall financial management.

HVAC Businesses Have Evolved

The HVAC industry is undergoing a transformation, reshaping the traditional definition of HVAC businesses. While HVAC companies originally focused on heating, ventilation, and air conditioning, they have now expanded to encompass a broader array of energy-efficient and sustainable technologies.

This evolution is driven by increased awareness of energy efficiency, technological progress, and government incentives. Clients are actively seeking HVAC businesses capable of delivering eco-friendly solutions. Advancements in technology enable the creation of HVAC systems that are not only more energy-efficient but also environmentally sustainable. HVAC businesses are now offering energy audits and consulting services, installation and maintenance services for energy-efficient and sustainable HVAC systems, and some are even expanding into new areas, such as electrical contracting and home automation, in order to offer their customers a more comprehensive range of energy-efficient and sustainable solutions.

Why HVAC Companies Are Adopting Credit Cards

In the HVAC industry, the adoption of credit cards has emerged as a strategic move for companies aiming to enhance their operational efficiency and client satisfaction. The shift towards electronic payment methods is driven by several factors, reflecting the evolving needs of both HVAC businesses and their customers. This section covers the reasons why HVAC companies are increasingly turning to credit card transactions.

Credit Cards Can Improve HVAC Operations

Embracing credit card payments in HVAC businesses brings with it the advantage of streamlined operations. Technicians can process transactions on-site using mobile devices, eliminating the need for time-consuming paperwork and reducing the risk of errors associated with manual processing. This not only accelerates the payment cycle but also enhances the overall customer experience.

Credit Cards Make Payments More Convenient for Customers

Customers today expect convenience in every aspect of their lives, and payment options are no exception. Accepting credit card payments allows HVAC businesses to meet these expectations, offering customers a hassle-free and secure method to settle invoices. This flexibility can contribute to increased customer loyalty and satisfaction, as clients appreciate the convenience of paying with their preferred method.

Credit Cards Can Bring You New Types of Customers

In a digital age where online transactions are the norm, accepting credit card payments opens up new avenues for HVAC businesses. Whether it’s through online booking platforms or virtual consultations, providing customers with the option to pay by credit card can attract a broader audience. This not only caters to tech-savvy clients but also positions your business as forward-thinking and adaptable to modern consumer trends.

Credit Cards Can Improve Your Cash Flow

Credit card payments facilitate faster transactions, leading to improved cash flow for HVAC businesses. Quicker access to funds allows companies to meet operational expenses promptly, invest in growth opportunities, and maintain a healthy financial position. Additionally, digital transactions provide a transparent and traceable record of all payments, simplifying financial management and reducing the likelihood of accounting errors.

The Ways HVAC Companies Accept Credit Cards

There are 5 key ways that HVAC and other trades accept credit cards. Depending on the type of job and whether you’re taking the payment in-person or remote, different payment methods are more popular.

Traditional Credit Card Machines

Tradition credit card machines (payment terminals) are wired or portable devices used for in-person transactions. HVAC employees can swipe, dip, or tap credit cards, ensuring quick and secure payments on-site.

Mobile Card Readers

Utilizing smartphones or tablets, HVAC companies can turn mobile devices into point-of-sale terminals. These devices are equipped with card reader attachments or integrated features, providing flexibility for on-the-go transactions.

Online Payments

HVAC companies often incorporate online payment systems on their websites. Clients can securely enter their credit card information to settle invoices, providing a convenient option for remote transactions.

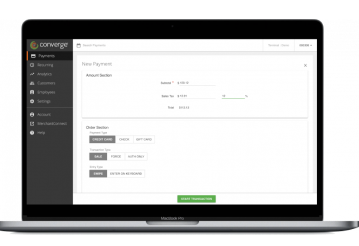

Virtual Terminal

Virtual terminals are web-based applications that allow HVAC companies to manually enter credit card information for payments using any web browser, smartphone, or tablet. It’s one of the easiest and fastest ways to accept credit cards.

Integrated Software Solutions

Some HVAC companies go for integrated software that seamlessly incorporates credit card processing within their existing business management systems or booking software. This ensures a streamlined approach to financial transactions and record-keeping.

Credit Card Fees For HVAC Companies

HVAC companies encounter three primary categories of fees when accepting credit cards: monthly fees, percentage fees, and transaction fees. These are described below or here is a full overview of fees in payment processing.

Percentage Fees: A portion of the fees HVAC companies face is the percentage fee, calculated as a percentage of the transaction amount. This fee, commonly known as the interchange fee, is determined by credit card networks and goes to the card-issuing bank. However, technically the percentage fee includes more than just the interchange fee. The percentage fee is generally between 1.9% and 2.9%.

Transaction Fees: Each credit card transaction incurs a fixed transaction fee. This fee, covers the operational costs of processing individual transactions. The transaction fee is generally between $0.08 and $0.30.

Monthly Fees: There is often a fixed monthly fee associated with credit card acceptance. These fees may include service charges, account maintenance fees, and any costs incurred for access to payment processing services. Monthly fees are generally between $10 and $30 per month.

Navigating and optimizing these three fee categories is crucial for HVAC companies seeking to strike a balance between the convenience of credit card transactions and managing associated costs effectively.

HVAC companies accept credit cards with TRC-Parus

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service