Top reasons businesses should accept credit cards

Accepting credit cards cost money for a business. That is likely the the main reason a business might not want to accept credit cards. It costs somewhere between 2% and 5% and there are many reasons for the wide range of cost. If you work with a good payment processor, you’ll be able to keep […]

What is interchange plus in payment processing?

Interchange plus pricing, sometimes called cost plus, is one of the common ways that payment processors price their services for merchants. There are two other forms of pricing models, which are flat-rate pricing and tiered pricing. In the end, interchange plus is regarded as the most transparent and fair for merchants. That’s why it’s not […]

History of Credit Cards

There is a long history of retailers or financial institutions providing credit for customers. In the 1800s and early 1900s, imagine going into your local general store and telling John to put it on your tab. Some stores turned this into a paper card to track your purchases. Now fast forward to 1950 and the […]

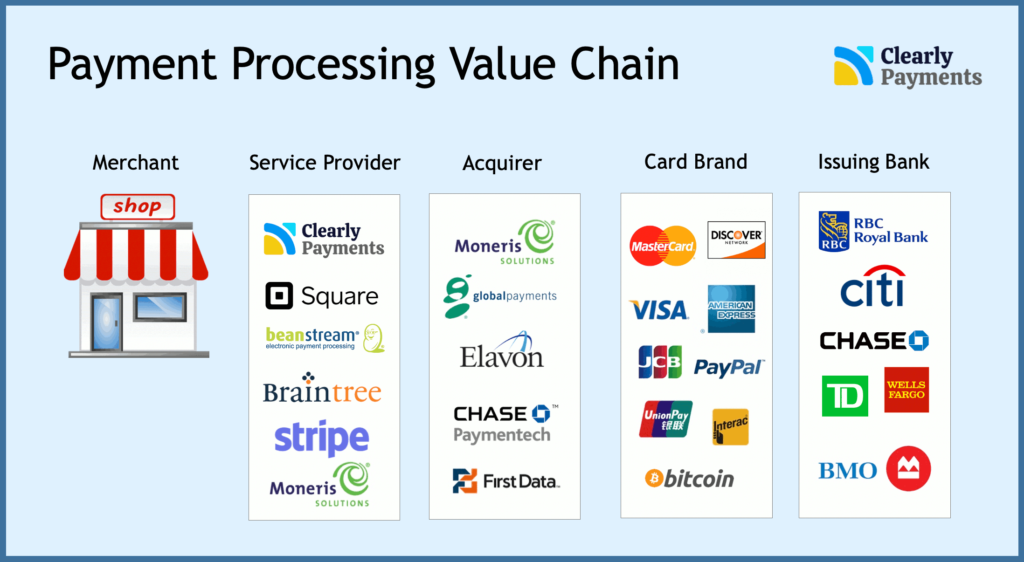

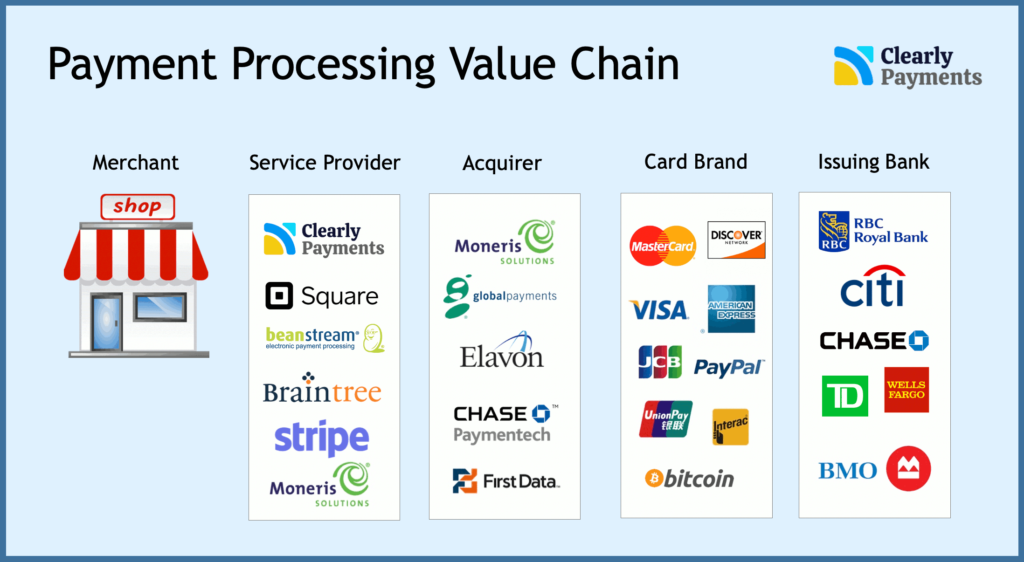

Credit card and payment processing industry overview

The payment processing industry is a sector of the financial industry that handles electronic payment transactions. It includes companies that provide payment processing services, such as credit card processing, debit card processing, electronic fund transfers, and online payment processing. These services allow businesses to securely transfer money electronically and make purchases online or in-store using […]

Declining use of cash. Cash vs Credit Cards.

It’s been a decade long trend. People are using cash less in favour of credit card and debit card payments. It’s a trend that will likely continue so merchants should be prepared. First, this is a slow trend. It’s not going to occur over night, but it is happening. To put some numbers to it, […]

What is a chargeback in payment processing?

Chargebacks can have negative implications for merchants. They result in financial losses as the revenue from the sale is lost along with associated fees. Dealing with chargebacks also requires time and resources, creating an administrative burden for the merchant. Here is an article on chargeback statistics for further reading. Excessive chargebacks can damage a merchant’s […]

How to create a return policy

A return policy is a must. Whether you allow returns or you don’t, a policy should be clear. There are statistics out there that around 10% of items purchased are returned and the number is even higher for online purchases, sometimes in the range of 25%. Having a clear policy sets expectations with your customers. […]

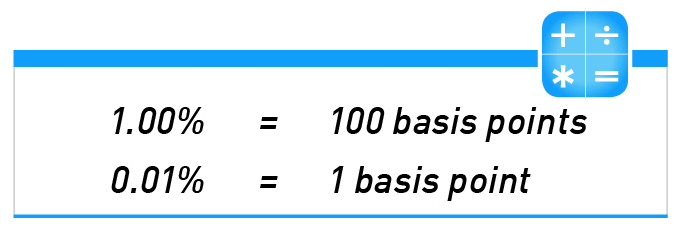

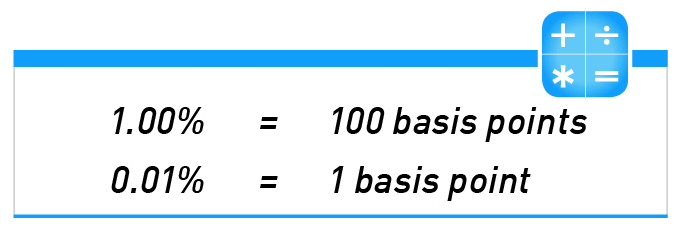

What are basis points?

When you’re in payments, you’re in an industry with thousands of competitors in a complex value chain. In fact, most of the industry involves just a handful of very large banks. However, the industry is so big that very large companies can be built by just taking a sliver of the industry. That’s why basis […]

Future delivery and payment processing

Future delivery is an important situation for some merchants in payment processing. It’s good to know how to deal with it and your payment processing account. In the payment processing industry, future delivery is considered higher risk. Therefore, the underwriting process to get a merchant account is a little more in depth. To start, future delivery […]

What you need to know about payment aggregation

Payment aggregators (aka third-party processors) are service providers that allow other businesses to accept credit cards without having to set up a merchant account. They make money by taking a percentage of credit card sales and also a transaction charge. Payment aggregators are a business on their own. They need to get approved for a […]